A continued increase in optimism on the economic outlook was brought about in December 2012 by reduced tensions in the euro area sovereign debt markets and rising stock markets, which supported equity funds in attracting their highest level of monthly net inflows since January 2011.

The European Fund and Asset Management Association (EFAMA) has today published its latest Investment Fund Industry Fact Sheet*, which provides investment sales and asset data for December 2012.

26 associations representing more than 99.6 percent of total UCITS and non-UCITS assets at end December 2012 provided us with net sales and/or net assets data.

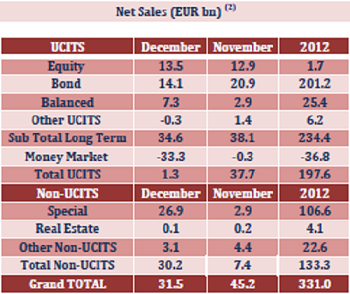

The main developments in December 2012 in the reporting countries can be summarised as follows:

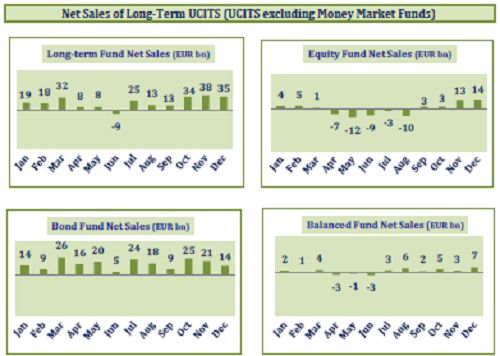

· Long-term UCITS (UCITS excluding money market funds) continued to register strong net sales in December: EUR 35 billion, compared to EUR 38 billion in November.

o Net sales of equity funds totaled EUR 14 billion, up from EUR 13 billion in November.

o Bond funds continued to record strong net inflows in December, albeit less than in November: EUR 14 billion compared to EUR 21 billion.

o Balanced funds recorded a rise in net sales to EUR 7 billion, up from EUR 3 billion in November.

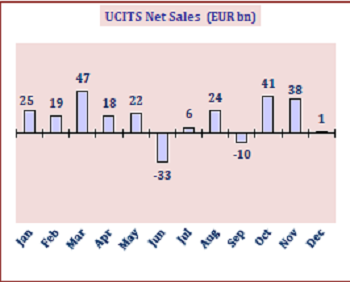

· Net inflows into UCITS amounted to EUR 1 billion in December, down from EUR 38 billion in November. This drop came on the back of large net outflows from money market funds.

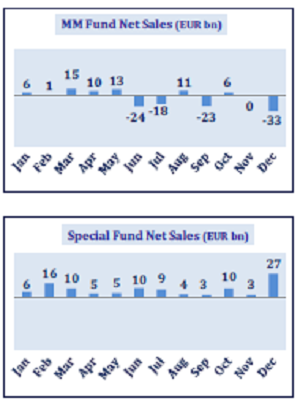

· Money market funds suffered from considerable net outflows (EUR 33 billion), which can be explained by cyclical end-year withdrawals.

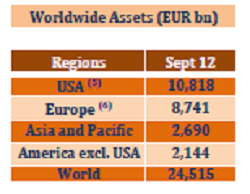

· Total net sales of non-UCITS increased substantially in December to EUR 30 billion, thanks to a surge in net sales of special funds (funds reserved to institutional investors) which rose to EUR 27 billion, up from EUR 3 billion in November.

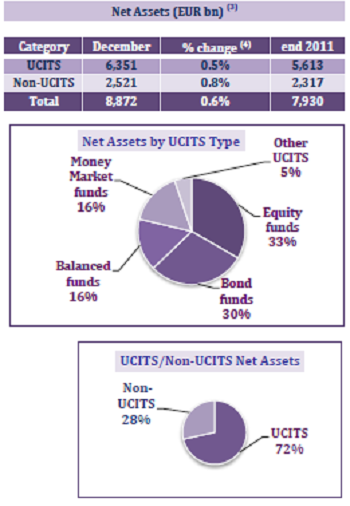

· Total net assets of UCITS increased 0.5 percent in December to EU 6,351 billion, whilst non-UCITS assets grew by 0.8 percent to EUR 2,521 billion. Total assets of UCITS and non-UCITS ended the year at EUR 8,872 billion, 0.6 percent higher than at end November.

The main developments in 2012 in the reporting countries can be summarised as follows[1]:

-

Net sales of UCITS amounted to EUR 198 billion (net outflows of EUR 90 billion in 2011).

-

Net sales of long-term UCITS totaled EUR 234 billion (net outflows of EUR 54 billion in 2011).

-

Money market funds registered net outflows of EUR 37 billion (net outflows of EUR 35 billion in 2011).

-

Non-UCITS recorded net inflows of EUR 133 billion (EUR 99 billion in 2011).

-

Special funds attracted net sales of EUR 107 billion (EUR 94 billion in 2011).

-

Overall, UCITS and non-UCITS recorded net inflows of EUR 331 billion (EUR 10 billion in 2011).

-

Net assets of UCITS and non-UCITS increased to EUR 8,872 billion (EU 7,930 billion at end 2011).

Peter de Proft, Director General at EFAMA, commented:

“2012 was a good year for the European investment fund industry and its clients, thanks to improved financial market conditions. Net sales of UCITS and non-UCITS totaled EUR 331 billion in 2012, whilst net fund assets increased by 12% over the twelve months to reach an all-time high of EUR 8,872 billion.

The strong demand for UCITS may be attributed to the decisive policy measures taken by the ECB and its commitment to do “whatever it takes” to save the euro. Progress in reducing fiscal imbalances and strengthening the governance of the euro area also supported investor confidence.

Overall, bond funds were the big winner as investors searched for yield in a sustained low growth, low interest rate environment. Equity funds have only benefited from improved investor confidence at the end of the year. This explains why they only attracted EUR 2 billion in new money in 2012. Still, this is a much better outcome than in 2011, which saw equity funds recording net withdrawals of EUR 70 billion.”

[1] Net sales data for countries reporting net sales on a monthly basis in 2011 and 2012.